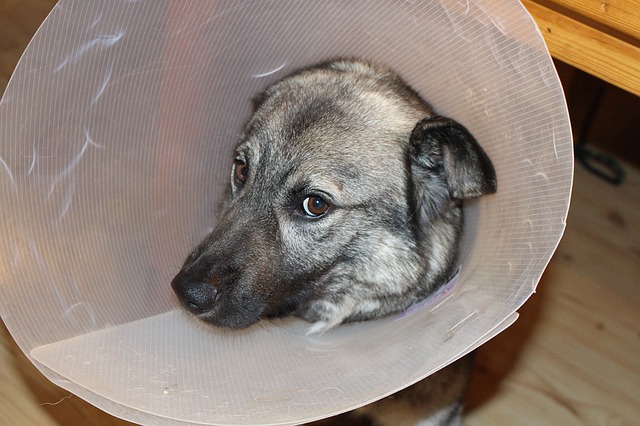

Pet Insurance: Here’s What Every Dog Owner Should Know

Pet Insurance: Here’s What Every Dog Owner Should Know

While pet protection isn’t new (the primary pet protection in the United States canvassed TV star Lassie in 1982), it is beginning to turn out to be more mainstream. A few organizations are in any event, beginning to offer it as an advantage to draw in and keep representatives. In any case, under 1% of the roughly 179 million pets in America are covered by pet protection.

So what precisely is pet protection? How can it function? Is it a sham or an opportunity to help you save your pet’s existence without agonizing such a huge amount over cost? Will it assist you with trying not to need to pick “financial killing” since you can’t manage the cost of treatment for your truly sick or harmed pet? Here’s the beginning and end you need to think about pet protection.

What Is Pet Insurance?

Pet protection is like human health care coverage. It settles clinical costs caused by wounds, sicknesses, or hereditary illnesses (contingent upon what kind of plan you buy). The extraordinary thing about pet protection is that you can go to any vet you need. There are no organizations to stress over. One of the disadvantages to pet protection is that they for the most part don’t work with your vet. More often than not, you take care of the vet bill yourself and are subsequently repaid by the insurance agency. On the off chance that you don’t basically have sufficient credit or reserve funds to cover a crisis vet bill of $2000 or more, pet protection may not help you in a crisis.

How Can It Work?

Actually like human health care coverage, you pay a month-to-month expense. Charges will change depending on whether you have a canine or a feline, what type of creature you have, how old your pet is, your postal district (since veterinary costs fluctuate from one area to another), and what kind of inclusion you buy. A few plans may just cover mishaps. Numerous plans cover mishaps and ailment, and a few plans additionally cover hereditary and breed-explicit sicknesses. By and large, mishap and sickness plans start around $22 per month for canines and $16 per month for felines. Your superior will typically go up consistently as your pet ages.

Previous conditions are quite often prohibited, and a vet visit inside the last year is normally needed before joining. There’s likewise typically a holding up period before benefits kick in, so if your pet gets sick or harmed before the finish of the holding up period, they will not be covered, yet that disease or injury may now be viewed as a prior condition and will not be covered once your inclusion kicks in.

After the holding up period, if your pet turns out to be sick or harmed, you will be liable for a deductible going from $100 to $2500, contingent upon what sort of plan you pick and which organization you choose to go to to to with. From that point onward, the insurance agency will repay you somewhere in the range of 65-90% of the remainder of the expense (note that a few plans repay a level charge and not a copay rate).

A few plans incorporate yearly or lifetime most extreme advantages, which is one more motivation to painstakingly consider each arrangement before picking one that best suits your necessities. Pet Insurance Review has a diagram to help you analyze inclusion between the most well-known pet insurance agencies in the United States that can help you start your quest for the right arrangement for your pet and your family.

What Are The Pros And Cons?

Masters:

Contrasting plans are simple. Pet protection is a lot easier to unravel than human health care coverage. Plans are genuinely direct, and looking at inclusion and expenses between various organizations is moderately simple. You can get a customized quote from any organization in no time, making picking a protection plan for your pet a lot simpler than picking one for yourself.

Expenses can be below. Youthful, solid pets on low levels of pet protection can have extremely low expenses. $22 per month for significant serenity that you’ll have help paying for any surprising huge vet bills is inestimable, wouldn’t you agree?

Deductibles are sensible. With deductibles as low as $100, a portion of the pressure of settling on crisis monetary choices when your pet is sick or harm can be taken out. Solid Paws Pet Insurance delivers a yearly report of the most widely recognized reasons pets visit the vet and the most costly payouts they had the earlier year. Last year, a German Shepherd who was hit by a vehicle piled up $23,043 of vet bills. The pet insurance agency repaid the proprietors $20,515. This is an outrageous illustration of how a deductible of up to $2500 can in any case save you a few thousand dollars.

You pick your own vet. Since the pet insurance agency repays you as opposed to working straightforwardly with your vet, you can take your pet to any vet that you pick without agonizing over whether they’re “in-network.” All you need to do is get the vet to round out a segment of the case frame and get a duplicate of the vet bill to submit to the insurance agency.

You can support your pet. Individuals with pet protection inclusion are bound to take their pet to the vet than those without it. It’s likewise simpler to choose how much cash you can bear to spend to save your pet’s life when you realize you can be repaid for an enormous piece of the costs. You presumably advise individuals you would successfully save your pet’s life – pet protection assists you with doing exactly that.

Cons:

Expenses can be high. On the off chance that your pet has a prior condition, is more established, is a variety with more normal afflictions than different varieties, or you pick a high level of inclusion, month-to-month charges can surpass $50 per month. $600 or more a year for protection inclusion your pet may never need may not bode well in your definite circumstance.

You actually need to settle front and center. On the off chance that you don’t have the investment funds or credit to pay those huge number of dollars of vet bills coming about because of your pet’s disease or injury, being repaid afterward turns into a debatable issue. Consider utilizing the cash you would spend on pet protection and put it into an investment account to be utilized on account of a veterinary crisis.

So Is It Worth It?

It’s difficult to know whether you will set aside or lose cash by getting pet protection for your hide family. Pet protection is truly about the true serenity of realizing that you will not need to stress very as a lot over the costs if something awful and startling at any point occurs. Could you end up paying hundreds or thousands of dollars in pet protection expenses and never end up recording a case? Indeed. In any case, realizing that you will be repaid for a portion of the expenses may permit you to make that one additional stride or attempt that one other treatment to save your pet’s life. It might mean the contrast between “take the necessary steps to save my pet’s life” and “kindly don’t spend more than $X attempting to save my pet’s life.”

If you do choose to join up with pet protection, you’ll get all the more value for your money the more youthful you can enlist your pet. Expenses will be lower and they are more averse to have previous conditions that would be prohibited from future inclusion. Most pet insurance agencies start inclusion on little dogs as youthful as about two months, with a couple of beginning as youthful as 6 or 7 weeks. Picking the most noteworthy deductible you can bear the cost of will assist with decreasing your month-to-month charges.

Regardless of whether you choose to pursue pet protection, you should begin a bank account to save for veterinary use. You never need to need to tell your vet that you can’t bear to save your pet’s life, and even with pet protection, you actually should have the option to deal with the vet bills as they happen. Nobody intends to have their canine get out the entryway and get hit by a vehicle or swallow something that can’t go through their stomach-related framework. On those occasions, your pet can hardly wait for you to ask, acquire, or take sufficient cash to cover their vet bills.